Bitcoin price dips as shutdown odds hit 67% – Is a local top ahead?

USDT turns soft during shutdown fears – Coincidence, or early signs of capital leaving the BTC cycle?

During periods of volatility, investors position around “liquidity” as a way to gauge the aggregate flow of capital across risk assets. Elevated liquidity signals strong participation and a higher risk appetite in the market.

Naturally, keeping a close watch on stablecoin flows is key over the coming weeks, as the odds of a government shutdown have moved above 67%, with traders pricing in a potential shutdown beginning on the 14th of February.

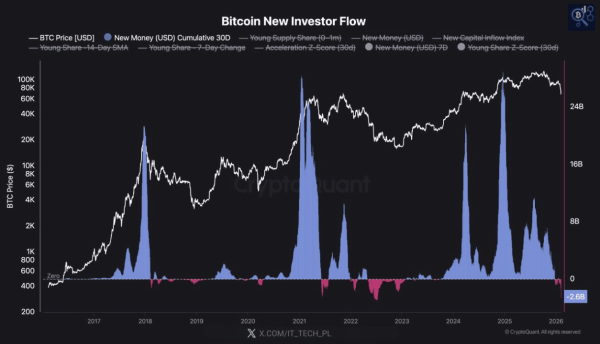

Technically, the timing couldn’t be worse. After a 1.88% intraday drop, Bitcoin [BTC] has slipped below $70k, failing to hold the level as support, while CryptoQuant data shows new capital inflows turning negative.

Source: CryptoQuant

Taken together, “despite” BTC’s 30%+ drop from its mid-January $97k peak, fresh capital still isn’t stepping in. In other terms, new investors still aren’t seeing a compelling risk–reward in Bitcoin at current levels.

Notably, this hesitation also aligns with how the market reacted during the previous shutdown cycle, when over $200 billion in liquidity was drained, BTC and ETH fell 20–25%, and altcoins were hit significantly harder.

During periods of extreme fear and uncertainty, capital often shifts into stablecoins, which are viewed as safer assets. This move is typically interpreted by the broader market as a positive signal for Bitcoin’s recovery once confidence returns.

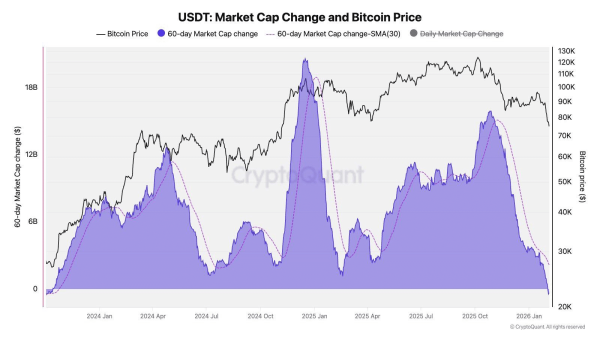

Yet USDT metrics have turned bearish amid growing shutdown fears. Naturally, the question arises: Is this a coincidence, or is capital deliberately moving out, bringing the Bitcoin “market-top” narrative back into focus?

USDT flows hint at tightening liquidity around Bitcoin

Содержание статьи:

Tightening liquidity is a direct reflection of fading risk appetite.

Notably, given where the market currently stands, this caution starts to make sense, from FUD around the new Fed nominee, stablecoin bill chaos, to China trimming U.S. Treasuries and ongoing tariff uncertainty.

Against this already FUD-heavy backdrop, recent shutdown fears are only adding pressure on Bitcoin investors. In this context, USDT’s market cap turning negative points to liquidity, leaving the system rather than positioning for an immediate risk-on move.

Source: CryptoQuant

Put simply, macro “fear” is outweighing dip-buying “greed,” suggesting investors still don’t view the current structure as a market bottom. The absence of fresh inflows reinforces the idea that confidence remains fragile.

On the contrary, tightening liquidity around Bitcoin alongside rising shutdown fears resembles the kind of setup that forms local or cyclical tops, where buying pressure is not strong enough to absorb the FUD.

In short, until liquidity stabilizes and capital meaningfully returns, BTC faces downside risk rather than a clean reversal. In that context, the $70k level reinforces the idea of a local top rather than a durable support zone.

Final Thoughts

- Despite Bitcoin’s 30%+ drop, weak USDT flows and negative inflows signal fading risk appetite rather than fresh capital stepping in. Macro fear, shutdown uncertainty, and fragile confidence keep Bitcoin exposed to further downside instead of a clean bullish reversal.

Next: Ethereum’s 2026 shift: Why proof-based validation matters for nodes

Source