Bitcoin vs Gold – Cathie Wood thinks THIS is why institutions are betting on both!

As Japanese rates rise and U.S liquidity tightens, Bitcoin proves its strength as a global macro asset.

For months, investors have debated whether Bitcoin [BTC] or gold is the better store of value. Even now, the debate is showing no sign of fading. Especially given the significant volatility across both price charts.

From a price perspective, Bitcoin has begun to recover somewhat after recent bouts of depreciation though.

At press time, BTC was trading at $70,681, up 3.03% in the last 24 hours. This may be a sign that investors are once again buying the dip, keeping the “digital gold” narrative alive.

On the other hand, gold has also exhibited strength, with its price rising by 2.03% to $4,966.26 per ounce, nearing the $5,000-mark. This appeared to be indicative of strong demand for traditional safe-haven assets.

That’s not all though as the Bitcoin vs gold debate is being reshaped by AI and institutional adoption too.

ARK Invest’s Cathie Wood on Bitcoin vs Gold

Содержание статьи:

According to Cathie Wood of ARK Invest, “agentic commerce,” where AI systems transact autonomously, is turning blockchains like Bitcoin, Ethereum [ETH], and Solana [SOL] into core financial infrastructure.

As a result, investors are increasingly focusing on these leading networks, with Bitcoin now viewed as a central part of modern portfolios rather than just a speculative asset.

Expressing the same, Wood added,

“Bitcoin is leading the way. It is the most secure of all the crypto.”

Factors causing Bitcoin’s decline

While rising Japanese interest rates, tighter U.S liquidity, and portfolio rebalancing are pressuring crypto markets, they reflect Bitcoin’s growing role in global finance rather than its decline.

In fact, the exec went on to say that the current volatility is largely driven by shifting global capital flows.

Slow growth in China and easing inflation fears have been weakening gold’s momentum, potentially redirecting capital towards Bitcoin. Thanks to the same, this asset class might now be entering a new transition phase beyond competition with AI stocks.

Importantly though, the relationship between Bitcoin and gold is also evolving.

Gold and Bitcoin seem to go hand in hand

Gold remains the trusted hedge in times of crisis and uncertainty, while Bitcoin is emerging as its digital counterpart, offering similar protection along with greater growth potential and programmability.

Remarking on the same, Wood noted,

“We wouldn’t be surprised if gold continued to come down to Bitcoin’s benefit.”

She added,

“Gold precedes a big move in Bitcoin”

Her statement implied that gold’s price action can act as a leading signal for Bitcoin’s next major move. In fact, according to Wood’s analysis, institutions are increasingly pairing both assets, gold for stability and safety, and Bitcoin for innovation and upside.

Together, they form a powerful hedge, shifting the question from “gold or Bitcoin” to “how much of each?”

Are Bitcoin market dynamics concerning?

At the time of writing, Bitcoin’s long-term outlook looked strong. However, short-term signals seemed mixed.

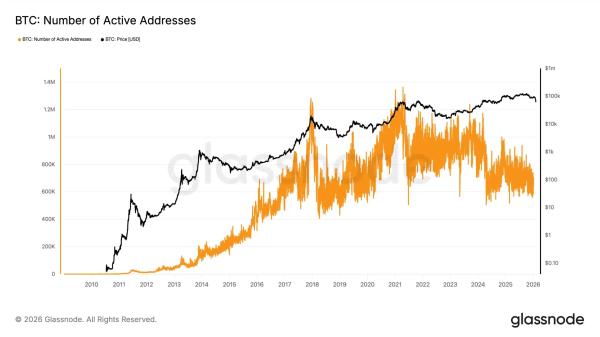

On-chain data from Glassnode underlined a decline in active users – A sign of weak retail participation.

Source: Glassnode

At the same time, Bitcoin’s market dominance climbed to around 59%, indicating that investors may be moving away from risky altcoins and back into Bitcoin.Finally, Wood again reiterated that Bitcoin’s traditional four-year cycle of sharp rallies and deep crashes is now breaking. This statement came on the back of her words on CNBC when she claimed that the prevailing downturn may be the mildest in its history.

Final Thoughts

- Institutional adoption is reducing extreme volatility and reshaping Bitcoin’s long-term market structure. Global pressures such as rising Japanese rates and tighter U.S. liquidity reflect Bitcoin’s growing role in global finance.

Next: Bitcoin’s road to recovery – Odds on price hitting $83K in the short-term are…

Source