Bitcoin’s dormant coins are mass-moving again: What it means for BTC

Bitcoin dormant coins are increasingly entering the market but Institutional demand remains elevated

Key Takeaways

Содержание статьи:

Bitcoin’s monthly CDD/Yearly CDD ratio surged to 0.25, signaling an increased distribution of dormant coins. BTC LTH distribution is unlikely to stop the rally, but only slow it down.

With Bitcoin [BTC] trading within a consolidation range of $120k -$117k, long-term holders are starting to distribute. As such, Bitcoin’s dormant coins are beginning to enter the market.

And that might be problematic for BTC. Here’s why.

Distribution by Bitcoin dormant holders surges

According to CryptoQuant’s analyst Axel Adler, Bitcoin recorded a significantly high monthly CDD/Yearly CDD ratio of 0.25 on the 24th of July. This ratio emerged within the $104,000 to $118,000 price range.

Source: CryptoQuant

Significantly, these levels are particularly critical because they are comparable to the historical peaks of 2014 and the correction of 2019.

For context, in 2014, after reaching a high of $1,000, BTC dropped 95% to a low of $111 following the Mt. Gox Scandal. In 2019, BTC rallied to $8,000, then corrected by 40% after China outlawed cryptocurrency trading.

That said, the recent spike in Monthly/Yearly CDD indicates that long-term holders (LTHs) are mass-moving BTC onto the market. Such CDD spikes signal active distribution by experienced players.

Source: Checkonchain

The declining Holder Net Position Change further evidences this increased distribution.

According to Checkonchain, Holder Net position Change has remained negative over the past week, hitting a low of -134.7k BTC.

Source: Checkonchain

At the same time, Bitcoin’s Long Term Holder Supply has declined from 14.12 million to 13.88 million, marking a 240k BTC drop.

Such significant drops imply that as Bitcoin rallied, long-term holders turned to distribution.

Historically, increased distribution from long-term holders has preceded lower prices as downward pressure on prices mounts. Thus, if the distribution continues, it could speak trouble to the current rally.

Institutional demand remains high

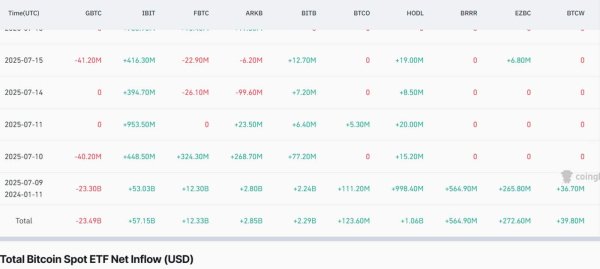

Interestingly, although long-term holders are selling, demand for Bitcoin from institutional investors remains relatively high. Examining Spot ETF inflows, the total net inflow has remained positive, except for GBTC.

Source: CoinGlass

As such, IBIT leads the charge with $57.15 billion, followed by FBTC with $12.33 billion, a clear sign of institutional accumulation.

Can it hinder BTC’s rally?

According to AMBCrypto’s analysis, Bitcoin has faced significant pressure from increased distribution by long-term holders.

As a result, the king coin remained stuck within a range, failing to reclaim its ATH of $123k. At the same time, treasury demand and BTC‑ETF inflows remain elevated.

Therefore, this demand is providing strong support by absorbing the arising selling pressure. Under the current circumstances, this distribution is unlikely to stop the rally, but will only slightly slow its pace.

That said, if distribution from LTHs cools down, BTC will be strong enough to retest its ATH and make another.

However, continuing the current trend would mean further consolidation within the $115,000-$120,000 range.

Subscribe to our must read daily newsletter

Next: S&P 500 Bitcoin exposure – Will Strategy be next after Block Inc.’s inclusion?

Source