Compound (COMP) – Is a major pullback next despite price gains of 23%?

Traders should watch out for a few key patterns on the price charts.

Compound (COMP) recorded gains of 23% on the charts recently. However, the altcoin has since flashed a bearish sign, with the same hinting at a potential price reversal. This conributed to its subsequent correction, with COMP trading at $20.51 at press time after hitting an intraday high of $22.84.

Market participants have been actively interested in the altcoin though as its trading volume surged by 502% to $307.95 million. Such a massive increase in volume alongside the price rally is a sign that traders and investors are actively engaging with COMP’s market trend.

Besides today’s upside move and the massive uptick in trading volume, one question every crypto enthusiast is asking is what’s next for the asset. Will COMP extend its rally, or is a corrective phase next?

Compound (COMP) price action and key levels

Содержание статьи:

AMBCrypto’s technical analysis of the daily chart revealed that COMP has been on a strong downtrend. Especially since it has been moving within a textbook-style descending channel pattern since August 2025.

Additionally, the chart revealed that in the past, whenever COMP’s price hit the upper boundary of this channel, it consistently recorded a strong price reversal.

Source: TradingView

Based on past performances and its price action, if COMP fails to break above this prolonged descending trendline, history may repeat itself. In such a case, the price could see a downside move of over 30% – Potentially falling below the $15-level.

However, the bearish thesis for COMP would only be invalidated if the asset breaks out of this pattern and closes a daily candle above the $24.85-level.

Additionally, the Average Directional Index (ADX), an indicator that measures the strength of a trend, climbed to 48.83 – Well above the key threshold of 25. This hinted at a strong directional move across the market.

Meanwhile, the Money Flow Index (MFI) hit 72.27, indicating strong buying pressure and overbought conditions. Such a combination of conditions often alludes to a potential short-term price pullback or consolidation.

Are traders flashing mixed signals?

Despite COMP’s recent price gains, derivatives tool Coinglass and on-chain analytics provider Nansen shared mixed signals from traders and investors.

For example – Coinglass’s COMP Spot inflow/outflow data revealed that more than $144.88k worth of COMP flowed out of exchanges in 24 hours. This hinted at potential accumulation.

Source: Coinglass

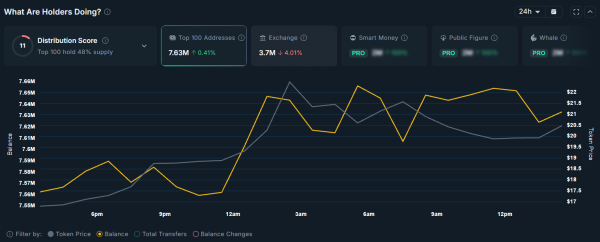

Meanwhile, Nansen highlighted a notable 4.12% decline in exchange reserves during the same period, further pointing towards accumulation behavior.

Source: Nansen

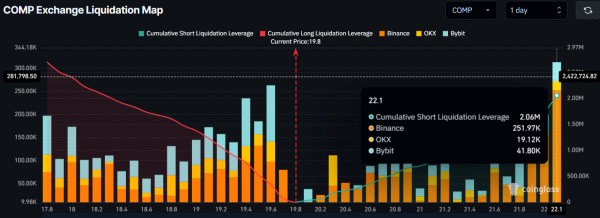

However, intraday traders appeared to be closely following the price action. According to the COMP exchange liquidation map, traders have been strongly positioning around $19.6 on the downside and $22.1 on the upside – Levels acting as key support and resistance.

Traders at these levels built $343.13k worth of long-leveraged positions and $2.06 million worth of short-leveraged positions. This implied that many traders strongly believe COMP is unlikely to break above the $22.1-level anytime soon.

Source: Coinglass

Final Summary

- COMP’s price hit the upper boundary of the descending channel pattern, with the price action hinting at a potential reversal. While intraday traders have been placing short positions, investors and long-term holders are continuing to accumulate.

Next: VIRTUAL rallies 10% – Can bulls flip $0.68 or face THIS risk?

Source