Crypto market sentiment plunges to extreme fear

Crypto market sentiment has fallen to extreme fear levels, with ETF data showing accelerating outflows, reinforcing a broader risk-off environment.

Crypto market sentiment has slipped decisively into extreme fear, with the Crypto Fear and Greed Index falling to 11, one of its lowest readings since late 2023.

The sharp deterioration reflects a combination of sustained price weakness, rising volatility, and persistent capital outflows, reinforcing a risk-off mood across the market.

Historically, sub-20 index readings have coincided with periods of heightened stress, forced selling, and broad de-risking.

Source: CoinMarketCap

While such levels have sometimes preceded medium-term market bottoms, they more immediately signal caution as participants retreat to the sidelines.

ETF outflows reinforce risk-off conditions

Содержание статьи:

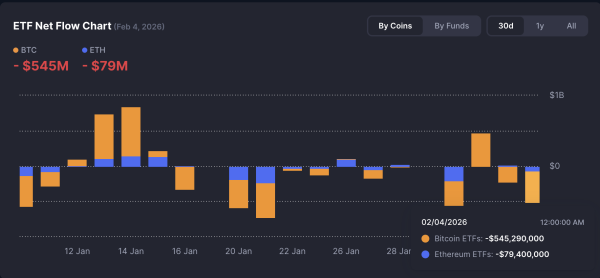

Adding to the pressure on crypto market sentiment, U.S.-listed crypto ETFs recorded heavy net outflows on 4 February.

Bitcoin ETFs saw net withdrawals of approximately $545m. In comparison, Ethereum ETFs posted outflows of around $79m, extending a trend of negative flows observed through late January.

Source: CoinMarketCap

The scale of the Bitcoin ETF outflows is particularly notable, given that spot ETFs had previously acted as a stabilising force during earlier drawdowns.

Instead, the latest data suggests institutional positioning has turned defensive, with investors reducing exposure rather than absorbing spot market selling.

Price weakness and volume fail to inspire confidence

Despite intermittent relief rallies, Bitcoin’s price action remains under pressure, and trading volumes have risen during downswings rather than rebounds.

This divergence typically reflects distribution rather than accumulation, reinforcing the fragile sentiment backdrop captured by the fear index.

Ethereum has mirrored this weakness, with ETF flows and price action pointing to broad-based caution rather than asset-specific concerns. Altcoins, meanwhile, have underperformed relative to the broader market, amplifying perceptions of systemic risk.

What extreme fear signals for the market

While extreme fear often attracts contrarian interest, current conditions suggest investors are prioritizing capital preservation over opportunistic positioning.

The combination of negative ETF flows, elevated volatility, and weak price structure indicates that confidence has yet to stabilize.

For sentiment to recover meaningfully, markets may require either a slowdown in ETF outflows, evidence of sustained spot demand, or a reduction in macro-driven uncertainty. Until then, the extreme fear reading underscores a market still searching for a firm footing.

Final Thoughts

- Sentiment has collapsed to extreme fear, reflecting persistent selling pressure and fragile confidence. ETF outflows remain a key overhang, signalling continued institutional risk aversion.

Next: CME to support Cardano, Chainlink, and Stellar – Potential impact on altcoins?

Source