EU pushes digital euro as dollar-backed stablecoins dominate crypto payments

The European Parliament has cleared a major hurdle for the digital euro as policymakers seek to counter the dominance of dollar-backed stablecoins.

The European Parliament has formally backed the creation of a digital euro. This clears a key procedural hurdle for the project as policymakers seek to counter the growing dominance of dollar-denominated stablecoins in global crypto payments.

According to reports, lawmakers voted 429 in favor, 109 against, and 44 abstentions to endorse a negotiating mandate previously agreed by EU finance ministers. This allows talks with the Council of the EU and the European Commission to move ahead.

The vote aligns the Parliament with EU governments. It marks the most significant political step forward for the digital euro to date, according to Reuters.

Online and Offline Design Takes Center Stage

Содержание статьи:

Under the agreed framework, the digital euro would be issued by the European Central Bank as a central bank digital currency [CBDC] with the same legal tender status as cash.

Crucially, it would be usable both online and offline, enabling payments without an internet connection through technologies such as NFC or hardware wallets.

Supporters say offline functionality is essential for resilience and privacy, particularly for small-value transactions and during network outages.

“The digital euro must be usable anytime, anywhere, whether online or offline,” said German MEP Stefan Berger, the Parliament’s lead negotiator on the file.

Stablecoin dominance shapes the policy rationale

The legislative push comes amid overwhelming dollarization in crypto payments.

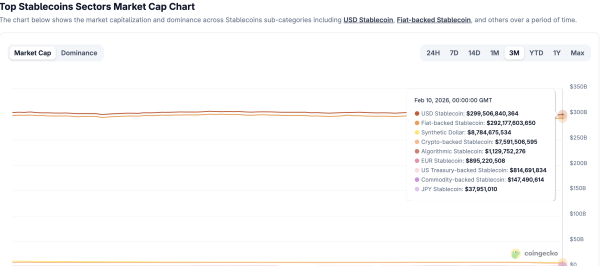

Data from CoinGecko shows that USD-denominated stablecoins account for well over 90% of the global stablecoin market. The sector’s total market capitalization is over $300 billion.

Tokens such as Tether’s USDT and Circle’s USDC dominate both centralized exchanges and on-chain settlement, with both having an almost $260 billion market cap.

Euro-based stablecoins remain marginal, with a combined market value of less than $1 billion.

Source: CoinGecko

EU officials have repeatedly framed the digital euro as a way to reduce reliance on private, foreign-currency payment instruments and to preserve monetary sovereignty as crypto adoption expands.

Long road to launch

The ECB is expected to decide in the coming months whether to move the digital euro into its next development phase. This follows a two-year investigation that concluded the project was technically feasible.

Even if legislation advances smoothly, officials have indicated that a launch would likely occur around 2029.

For now, the Parliament’s vote signals political momentum rather than immediate deployment.

However, as dollar-backed stablecoins continue to cement their role as the default settlement layer in crypto markets, the EU’s digital euro effort is increasingly framed as a strategic response to a payments landscape that has already globalized around the U.S. dollar.

Final Thoughts

- EU lawmakers are advancing the digital euro as USD stablecoins entrench their dominance in crypto payments. Offline functionality positions the digital euro as a cash-like alternative rather than a direct crypto competitor.

Next: Analyzing if Polygon’s 94M stablecoin transfers milestone will push POL to $0.1

Source