Mapping Bitcoin’s liquidity slowdown as old coins re-enter circulation

At current pace, BTC risks going into consolidation.

Bitcoin’s [BTC] rally seems strained. Long-held coins are beginning to move, liquidity is thinning, and nothing looks as straightforward as before.

The market is at a crossroads – the next move may depend on how capital flows evolve from here.

Old coins are moving again

Содержание статьи:

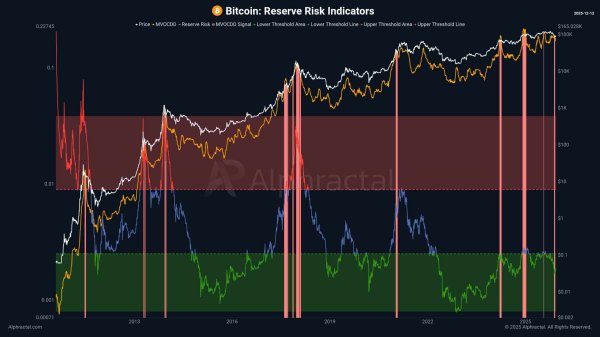

Data shared by Joao Wedson, CEO of Alphractal, showed that Bitcoin now has four clear distribution alarms – a first in its history.

Source: Alphractal

The Reserve Risk indicator, which tracks movements of older, dormant coins, has repeatedly flashed sell signs since 2024. What this means is that early holders are steadily releasing BTC back into circulation.

Source: Alphractal

Much of this supply appears to be flowing into exchanges, ETFs, and institutional vehicles, right at the peak of market attention. So far, similar patterns have come up late in previous cycles, often a change from rapid upside to a slower, more fragile time.

Liquidity lagging behind?

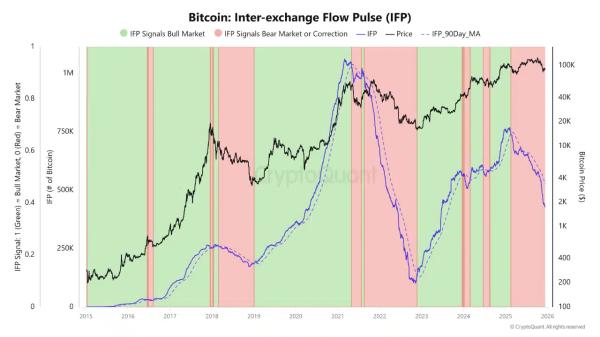

As old coins move back into circulation, the flow of liquidity between exchanges is losing strength.

The Inter-exchange Flow Pulse (IFP) is trending lower and slipping below its 90-day moving average, a level that has often meant slower or corrective phases in past cycles.

Fewer positive flows are moving across exchanges to support the rally.

Source: CryptoQuant

What’s interesting is that Bitcoin’s price is still holding near cycle highs, even as this support fades. This kind of mismatch has so far meant consolidation rather than selloffs.

Unless inter-exchange flows recover, Bitcoin may struggle to sustain upside in the near term.

It’s showing up on the price chart too

Bitcoin traded near $90,000 at press time, but remained below its key short and long-term moving averages – a loss of trend strength.

The RSI showed no strong buying or selling pressure. At the same time, on-balance volume flattened, so there’s a lack of fresh demand entering the market.

Source: TradingView

Bitcoin may be beginning a consolidation stage.

Final Thoughts

- Bitcoin’s rally is losing structural support. With BTC near $90K but flows thinning, the market may be entering consolidation.

Next: Strategy keeps Nasdaq 100 spot – Will MSCI force $2.8B in outflows?

Source