Solana: Is 3.3K TPS strength masking SOL’s weak protocol revenue?

Solana outpaces rivals in activity, yet revenue gaps and whale losses underscore the divide between scale and economic value.

Transaction dominance, not price strength, now defines Solana’s [SOL] market narrative.

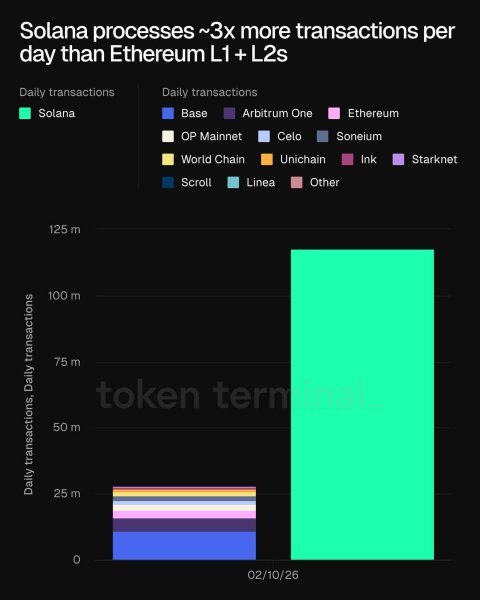

According to TokenTerminal data, it processes roughly three times more daily transactions than Ethereum [ETH] L1 and all L2s combined. This scale establishes Solana as a high-throughput execution leader.

Source: TokenTerminal

Moreover, data showing roughly 285 million in daily transactions and 3,300 TPS explain this advantage. Consequently, processing and ultra-low fees structurally enable such volume.

Consequently, user engagement rises, reflected in 2.6 million active addresses. This activity strengthens Solana’s appeal for DeFi trading, payments, and high-frequency applications.

However, transaction composition matters. Vote transactions inflate totals, while true user TPS remains lower. Success rates near 40–50% also highlight congestion and bot-driven demand.

Thus, Solana’s throughput leadership accelerates ecosystem adoption and liquidity velocity, though reliability optimization remains critical for sustaining long-term network growth.

Solana’s usage vs. value

Содержание статьи:

Solana’s transaction dominance does not fully translate into proportional monetary throughput. The network processes about 86 million non-vote transactions daily, yet generates roughly $622,000 in chain fees.

In contrast, Tron [TRX] produces roughly $948,000 daily despite lower activity, with stablecoin transfers driving stronger fee consistency. Solana’s ultra-low costs, averaging $0.003–$0.007 per transaction, enable massive scale but suppress protocol capture.

Source: DeFiLlama

However, value formation shifts to the application layer. Solana records approximately $7.57 million in total fees paid, including $6.66 million from apps.

However, Ethereum exceeds this, generating about $18 million in total fees and $11.7 million in app revenue. It also captures a stronger protocol value near $107,000 through burns and MEV.

Thus, while Solana leads in execution volume and app momentum, Ethereum and Tron retain deeper monetization efficiency, highlighting a structural gap between usage scale and monetary capture.

Whale liquidation signals rising sell pressure

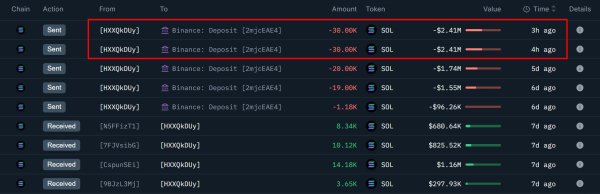

Despite execution leadership, economic weaknesses invite volatility. Whale behavior now reflects stress within capital positioning. The wallet deposited 60,000 SOL, worth $4.42 million, into Binance through phased transfers.

Two 30,000 SOL deposits alone totaled $4.82 million within hours. Earlier tranches—20,000, 19,900, and 1,180 SOL—pushed cumulative exchange inflows above 100,000 SOL.

Source: OnChainLens/ X

This sequence followed an initial 111,945 SOL withdrawal, valued near $17.16 million, originally allocated to staking. The return flow realized roughly $9.78 million, locking in a $7.38 million loss, or about 43%. Such staged deposits often aim to reduce slippage during liquidation.

Meanwhile, loss realization at this scale introduces localized sell pressure, reinforcing defensive sentiment as SOL trades near post-drawdown ranges.

Final Thoughts

- Solana’s transaction supremacy drives adoption and liquidity velocity, yet ultra-low fees limit protocol revenue, creating a structural gap between usage and value capture. Rising whale liquidation and realized losses add near-term sell pressure, reinforcing defensive sentiment despite Solana’s expanding execution leadership.

Next: Dogecoin: How traders can react to DOGE’s possible $0.10 move

Source