Tokenized gold tops $2.5B in value! – Why investors are buying in

With spot prices rising, blockchain-based gold is becoming a top pick for investors.

Key Takeaways

Содержание статьи:

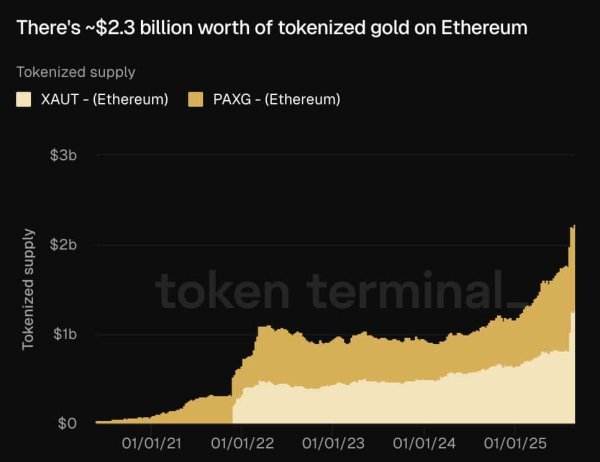

Tokenized gold surged to a record $2.59 billion market cap, fueled by rising spot prices. With $2.3 billion supply on Ethereum, it’s rapidly becoming the bridge between traditional assets and the on-chain economy.

Gold isn’t just glittering in vaults!

Tokenized gold has hit a record $2.59 billion in total value, a sign that investors are warming up to digital wrappers of real-world assets.

With physical gold prices going closer to an ATH, it seemed like traders have been looking for quicker, easier ways to get exposure without dealing with the hassle of bars and bullion.

Tokenized gold hits $2.5 bln market cap

At press time, tokenized gold’s market cap stood at $2.59 billion, with 24-hour trading volumes nearing $494 million.

Source: CoinGecko

Leading the pack are Tether Gold [XAUT] and PAX Gold [PAXG], which together account for more than $2.3 billion worth of supply on Ethereum [ETH].

Source: X

Both tokens mirrored gold’s surge, with XAUT trading around $3,475 (+3.5% in the past month) and PAXG at $3,494 (+4.0%). UGold Inc. also gained, rising 1.5% to $3,660.

Gold inches toward April highs

This surge rode on bullion’s own rally. Spot gold traded around $3,485 per ounce at press time, going closer to its April peak.

Source: TradingView

The move has been fueled by a steepening U.S. Treasury yield curve, which often pushes investors toward safe-haven assets. After weeks of sideways action, gold has climbed nearly 6% since mid-August, regaining momentum.

Why tokenized gold is gaining momentum

So what’s fueling the rush into tokenized gold?

For one, it makes ownership simpler. Investors can buy fractions of an ounce, trade 24/7, and skip storage headaches. On top of that, borderless transfers and smart contracts automate redemption seamlessly.

Beyond retail investors, institutions and DeFi platforms are integrating tokenized gold into their systems, unlocking new use cases.

In essence, it offers the stability of physical bullion with the flexibility and efficiency of blockchain technology, making it ideal for the on-chain economy.

Subscribe to our must read daily newsletter

Next: Arbitrum price prediction: Can ARB reach $0.75 after surging activity?

Source