VIRTUAL falls 12% in a day after $1M outflows – Can bulls recover?

VIRTUAL bullish momentum fades as bears take over.

Key takeaways

Содержание статьи:

VIRTUAL’s recent rally has reversed, with bears regaining control as spot and derivatives investors collectively sell. Funding Rates across top exchanges have dropped, while volume and liquidity move away from the asset.

The Virtual protocol [VIRTUAL] has recorded one of the steepest declines in the past 24 hours, driving liquidity outflows from exchanges with a 12% price drop, at press time.

This positions it among the worst-performing altcoins in the market, down 28% according to the Altcoin Season Index.

Continued selling in both derivatives and spot markets could exert further downward pressure on the asset, increasing losses. AMBCrypto examines the factors driving this trend.

Investors’ outflow pressures VIRTUAL

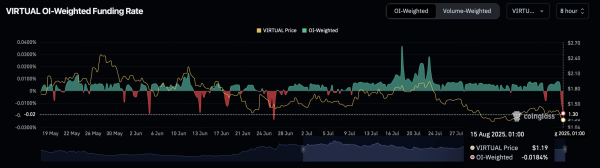

Derivative market sentiment has turned fully bearish, with the OI-Weighted Funding rate flipping to negative.

At the time of writing, the metric stood at -0.0184%, confirming that bearish positions now dominate open contracts. This is the lowest reading since late June, when VIRTUAL also suffered a sharp price drop.

Source: CoinGlass

Adding to the negative sentiment, the volume-based Weighted Funding Rate also turned negative, reflecting weakening bullish momentum as bears strengthen their grip.

For now, derivatives data suggests investors see little potential for a price rally, with bearish positioning proving more profitable.

Spot market adds to the selling pressure

In the past 48 hours, spot market investors have added to the sell-off, with roughly $1 million in outflows recorded.

This trend suggests traders now prefer holding other VIRTUAL trading pairs they view as more profitable over the long term.

Source: Arkham

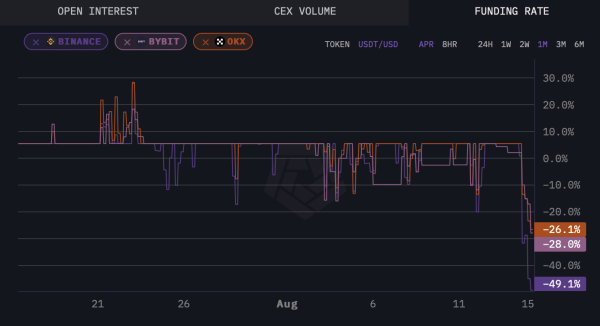

Funding Rate data showed that the remaining liquidity on exchanges is skewed toward a price drop.

Arkham Intelligence reported that the top three centralized exchanges—Binance, Bybit, and OKX—have seen their Funding Rates fall to 49.1%, 28.0%, and 26.1% respectively, as of writing.

A continued outflow in this direction would make a price rebound increasingly unlikely.

VIRTUAL price outlook

VIRTUAL’s chart sentiment appeared neutral, at press time.

The latest drop followed a failed attempt to reclaim a bullish triangle pattern, pushing the price down to a key support level at $1.16.

A bullish case could emerge if the asset rebounds from this support and reclaims its lost bullish structure.

Source: TradingView

However, a break below this support would likely trigger another bearish round, with the potential for a deeper decline as no significant support remains to cushion further losses.

Subscribe to our must read daily newsletter

Next: dogwifhat drops 11% – Here’s how WIF can reclaim $1

Source