ZCash short-term momentum solidifies: Here’s what you can expect this week

The ZCash bulls have overcome the $300 local resistance with ease, but can they defend it and push prices higher?

ZCash [ZEC] rebounded from a key long-term support level at $187.9. In a recent report, AMBCrypto explored how the long-term bias of ZEC might not be as bearish as feared.

The weekly swing structure has held, and there was hope.

A recovery might not be imminent. With Bitcoin’s [BTC] bearish woes, ZEC might enter a deeper consolidation and fall below $187 in the coming weeks.

But, for now, the short-term momentum was bullish. According to CoinMarketCap, ZCash has rallied 9.88% in the past 24 hours with a 25% increase in daily trading volume.

The $300 resistance has been overcome, but the main threats overhead were at $365-$460.

What to expect from the ZEC price action this week

Содержание статьи:

Earlier, the importance of the $365-$450 supply zone was explained using the 1-day chart. Zooming into the lower timeframe price charts only reinforced this view.

Source: ZEC/USDT on TradingView

Using the H4 bearish impulse move to $184 and its Fibonacci retracement levels, we can see why $320 and $357 are key local resistances. To the south, there were imbalances in this timeframe at $300, $260, and $240.

The OBV has made new highs for the month of February, but the RSI and Stochastic RSI showed overbought conditions. This indicated a potential correction ahead.

The upcoming price dip might not extend as deep as $240. This was because of the $300 level, which was a local resistance that the price rocketed past and left behind an imbalance, or fair value gap, in the process.

ZEC will likely respect this and continue higher, although a few hours of consolidation could ensue.

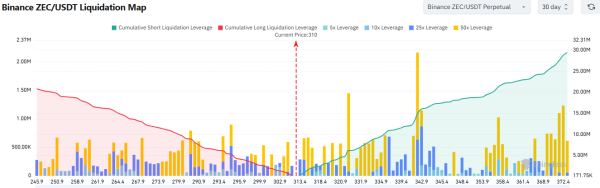

Source: CoinGlass

Another compelling reason why ZEC will likely run higher before correcting was seen in the liquidation map. The $342 and $360 regions had considerable cumulative short liquidation leverage.

Since price is attracted to liquidity, a move higher seemed more likely in the coming days than a drop below $300.

At the same time, traders shouldn’t FOMO into long positions. Bitcoin tested the $70k resistance in recent hours and could see rejection over the next 24 hours. If it does, it can drag ZEC lower.

Final Summary

- The ZEC bulls have reclaimed the $300 former local resistance as support, at least for now. If Bitcoin does not see strong selling pressure in the near term, a ZEC move to $360 is more likely than a breakdown below $300.

Next: Dogecoin rallies 18% after Smart Cashtags reveal: Can DOGE hold above $0.11?

Source