Bitcoin’s $70.5K ceiling holds as whales flood exchanges: What’s next?

Bitcoin faces mounting pressure as whales and retail traders intensify sell-side activity.

Bitcoin [BTC] continues to face persistent pressure as market sentiment remains firmly bearish.

Over the past 12 days, the asset has failed to record a single daily close above the $70,500 level, underscoring the strength of the ongoing resistance and sustained sell-side momentum.

A meaningful recovery does not appear imminent. Both whale behavior and retail participation point to the likelihood of extended downside pressure, which could keep Bitcoin trading near the lower end of its recent range.

Whales increase exchange activity

Содержание статьи:

Whales, defined as investors holding large amounts of an asset with the capacity to influence market direction, have played a central role in recent developments.

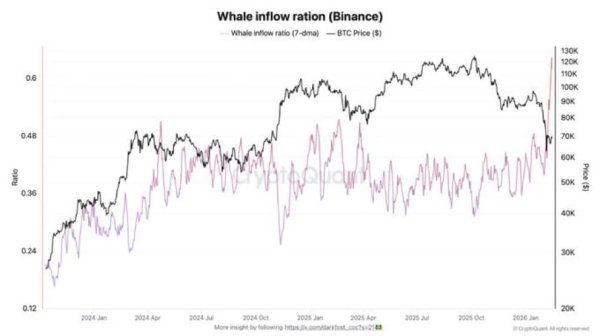

Between the 2nd and the 15th of February, whale Bitcoin movements displayed a clear distribution pattern. Data from Binance’s Whale-to-Exchange Ratio supports this observation.

This metric measures the proportion of the top 10 inflows relative to total inflows on the exchange, offering insight into large-holder activity.

Source: CryptoQuant

According to CryptoQuant, the ratio surged from 0.4 to approximately 0.62 during this period, indicating that a greater share of Bitcoin deposits to Binance came from whales.

Given Binance’s position as the largest exchange by trading volume and liquidity, this shift carries notable implications for broader market dynamics.

Historically, rising exchange inflows signal sell-side pressure, as investors typically transfer assets from private wallets to exchanges in preparation for potential liquidation.

A CryptoQuant market analyst operating under the pseudonym Darkfost attributed the surge partly to broader market uncertainty:

“[This is] not only due to Binance’s deep liquidity, but also because the uncertain market environment is prompting all types of investors to reassess their exposure and strategy.”

Elevated whale inflows increase the available supply on exchanges, which can materially weaken Bitcoin’s short-term outlook.

Whales dominate Spot activity

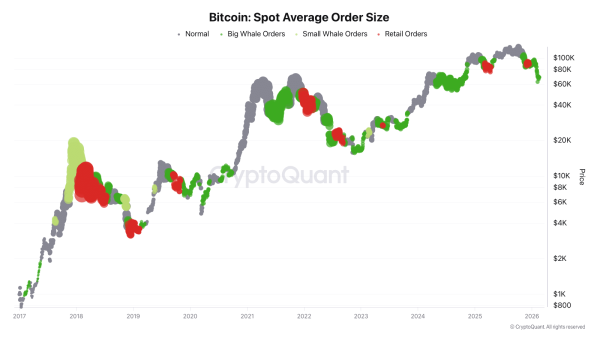

To determine whether whale movements were merely transfers or active trading, additional metrics offer confirmation. Data shows whales are not only moving funds but also participating actively in the Spot market.

The Spot Average Order Size, which divides total trading volume by the number of executed trades across major centralized exchanges, indicates a sustained presence of large traders.

At the time of writing, the average order size stands at approximately 915 BTC (around $63 million).

Although slightly lower than the level of 927 BTC ($63.9 million) on the 2nd of February, the difference remains marginal and confirms continued whale dominance in Spot trading activity.

Source: CryptoQuant

At the same time, exchange reserves have increased.

Since the 10th of February, exchange reserve data—which tracks the amount of Bitcoin held on exchanges—has risen by roughly 12,000 BTC, valued at approximately $827 million at current prices.

If this additional supply enters the Spot market, it could exert further downward pressure on price, potentially pushing Bitcoin toward the $65,000 region.

Retail investors add to downside pressure

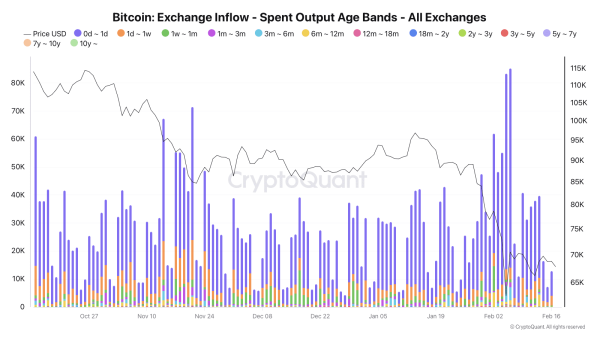

Retail traders remain active and are contributing to market dynamics. Analysis of the Exchange Inflow–Spent Output Age Bands metric shows heightened activity among short-term holders.

This metric categorizes Bitcoin transferred to exchanges based on how long the coins were held before movement.

Current data indicates that short-term holders—typically associated with retail investors—dominate inflows.

On the 16th of February alone, coins held between 0 and 1 day accounted for more than 8,880 BTC transferred to exchanges.

This trend has persisted in recent weeks, with retail-driven capital flows leading overall exchange activity.

Source: CryptoQuant

Similarly, coins held between 1-7 days—another short-term cohort—rank next in volume contribution.

Retail investors, by definition, often operate with shorter investment horizons. They tend to realize profits or cut losses quickly rather than hold through extended volatility.

Their heightened participation during this period reinforces the broader sell-side pressure weighing on Bitcoin.

Final Summary

- Bitcoin whale inflows to Binance add further strain to the asset’s near-term outlook. Whales have dominated Spot volume for over a month, while retail investors contribute to sustained downside pressure.

Next: Nexo returns to the U.S. after 3 years – What’s different this time?

Source