Peter Schiff to Saylor: ‘Congratulations’ after $168mln BTC buy but warns of…

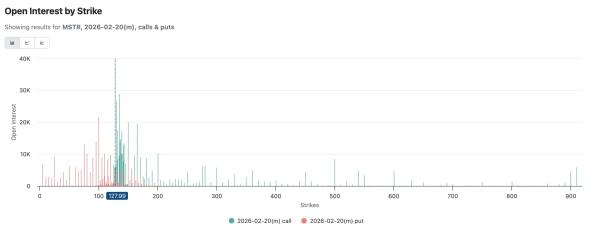

Options markets point to $100 support and $150 resistance, outlining MSTR’s critical battle zone in 2026.

Michael Saylor has built his reputation around the idea that companies should hold Bitcoin as a core treasury asset. On the other hand, Peter Schiff has spent years criticizing BTC and warning that it will eventually fail.

But this week, something surprising happened.

Saylor’s company, Strategy, announced that it bought another 2,486 BTC, bringing its total Bitcoin holdings to 717,131 BTC, valued at more than $54.5 billion.

With this, Strategy now controls about 3.4% of all the Bitcoin that will ever exist.

The latest purchase alone cost about $168.4 million, with Bitcoin bought at an average price of $67,710. But what’s even more surprising is? Schiff gave a rare, almost reluctant acknowledgment of the scale of this move.

Schiff turns praise into a warning

Содержание статьи:

Responding to Saylor’s tweet, Schiff said,

“Congratulations, you finally averaged your price down.”

Yet despite showing mild appreciation, Schiff has returned to warning against Saylor’s strategy. He has criticized Saylor’s habit of “averaging down,” which means buying more Bitcoin when prices fall.

In simple terms, he believes that if Bitcoin [BTC] keeps dropping, buying more could only increase overall losses.

MSTR and BTC price action and more

At the same time, Strategy’s stock and BTC are giving a concerning picture of the market.

As per Google Finance data, MSTR was trading around $128.67 and has fallen nearly 4% in the short term and close to 20% over the past month.

Bitcoin, too, was struggling, trading near $67,661 and falling about 26% over the last 30 days.

Another important signal comes from Open Interest.

Source: CoinGlass

Earlier, Open Interest was very high, showing that many traders were using borrowed money and taking big risks. Now, both Bitcoin’s price and Open Interest are falling together.

This shows that risky traders are leaving and losses are forcing weaker players out. In simple words, the market is cooling down, and long-term, serious investors are slowly replacing short-term speculators.

MSTR’s Open Interest analysis

Meanwhile, MSTR’s options market suggested that many traders see $100 as a strong support level where buyers may step in, while heavy selling between $130 and $150 makes this range hard to cross. Some high-risk bets at $200 and $300 show that hope for a major Bitcoin-led rally is still alive.

Source: OptionCharts

As of press time, MSTR moved between $110 and $140, showing market uncertainty.

A clear move above $150 could lead to a fast rally, while a drop near $100 may attract buyers. Overall, Strategy remains caught between long-term confidence and serious financial risk.

Now, whether this bold approach succeeds will largely depend on whether Bitcoin regains strength or continues to decline.

Other firms and their Bitcoin strategy

While Strategy keeps buying more Bitcoin, its Japanese counterpart, Metaplanet, is under pressure. In its Q4 2025 earnings report, the company posted a huge net loss of $619 million.

Therefore, as 2026 moves forward, these firms won’t be judged by short-term profits, but by how well they handle sharp 20–30% price drops.

For now, their approach is to buy on dips, ignore market noise, and wait for the next cycle to turn losses into long-term gains.

Final Summary

- Peter Schiff briefly acknowledged Saylor’s move but still believes “averaging down” could lead to bigger losses. Falling Open Interest suggests risky traders are leaving, and the market is shifting toward more serious, long-term players.

Previous: Abu Dhabi funds ‘buy the dip’ with $1B in BlackRock’s Bitcoin ETF Next: Bitcoin: Jane Street’s 7.1 mln IBIT buy shows why BTC’s $65k support is fragile

Source