Chainlink whales load up below $12 – Is LINK heading toward $5 next?

Whales bought the dip, but LINK’s structure keeps raising a tougher question about what breaks next.

Chainlink remained stuck in consolidation after losing the $20 level in 2025, with downside risks refusing to fade.

Price action stayed compressed beneath resistance, keeping bearish pressure alive despite brief relief rallies.

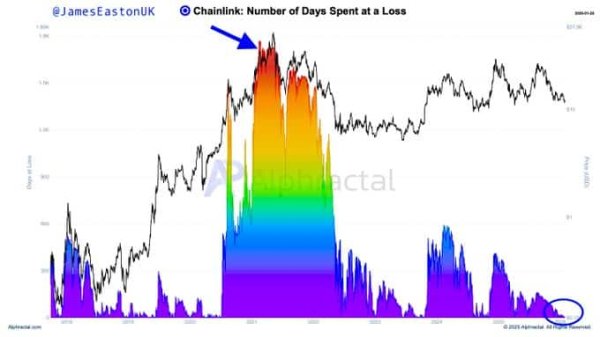

Source: Alphractal

On-chain data showed Chainlink [LINK] continued to spend extended periods at a loss, echoing conditions seen near prior cycle peaks.

That backdrop left investors questioning whether this consolidation reflected accumulation or prolonged distribution.

As the dominant decentralized oracle network supplying off-chain data to smart contracts, Chainlink has survived past crypto winters.

Whether it could endure this phase without further damage remained an open question.

Whales aggressively buy LINK below $12

Содержание статьи:

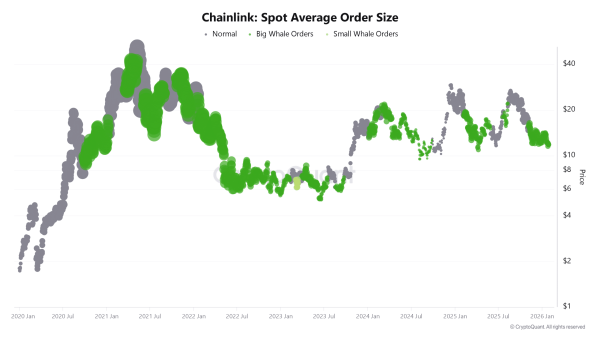

Whales had been circling LINK like vultures. Since LINK fell below $14, large players had been buying every dip, with their focus shifting to $12.

But let’s be honest—these whales weren’t acting out of love for the project. They were capitalizing on the bleeding, picking up scraps while LINK struggled to find support.

Source: CryptoQuant

Despite their aggressive moves, the lack of clear bullish momentum made these whale moves seem more opportunistic than a sign of future growth.

As usual, these whales could have been the ones profiting the most from a continued downward spiral.

Chainlink loses 50% and 61% on the Fib retracements

On the 4-hour chart dated the 29th of January, LINK’s RSI dropped to 36.44, hovering just above oversold territory.

At the same time, price lost the 50% and 61% Fibonacci Retracement levels near $12.99–$13 and $12–$12.50. The major support between $11.37 and $11.64 on this time frame was also slipping away.

Source: TradingView

The loss of these critical retracement levels suggested that LINK was too weak to mount a meaningful comeback anytime soon.

Unless it reclaimed the 61% and 50% levels, the market appeared to be in serious trouble. A market that couldn’t hold these levels was a market in danger.

LINK forms a bearish head and shoulders pattern

On the daily timeframe, LINK printed a clear bearish head and shoulders pattern.

The neckline near $10.06 marked a critical line, with a confirmed break opening downside risk toward $4.91.

Source: TradingView

The left shoulder, head, and right shoulder formed beneath repeated rejections near $27, reinforcing the bearish setup.

Unless LINK reclaimed the $14 region decisively, bulls appeared sidelined, leaving sellers in control.

Final Thoughts

- LINK stayed weak after losing key Fibonacci levels near $13, with RSI showing fading momentum and sellers still in control. Chainlink whales bought below $12, but the price failed to reclaim $14.

Next: Bitcoin: Is seller exhaustion behind BTC’s lack of real demand?

Source