Bitcoin falls below $72,000 as weak spot demand and long liquidations pressure price

Bitcoin slipped under $72,000 on 5 February as negative Coinbase premiums and a surge in long liquidations accelerated the downside.

Bitcoin slipped below $72,000 on 4 February, extending its recent downtrend and marking a fresh local low amid intensified selling pressure across spot and derivatives markets.

At the time of writing, Bitcoin was trading around $71,800, down roughly 5% on the day, after briefly dipping to an intraday low near $71,700, according to TradingView data.

The move places BTC at its weakest level since late 2024. It confirms a broader breakdown from the consolidation range that had held through much of January.

Source: TradingView

Spot market weakness deepens

Содержание статьи:

Spot price action shows a clear sequence of lower highs and lower lows following Bitcoin’s failure to reclaim the $90,000–$92,000 resistance zone in mid-January.

Since then, repeated sell-offs have pushed price through successive support levels, with $80,000 and $75,000 offering little sustained demand.

Source: Coinglass

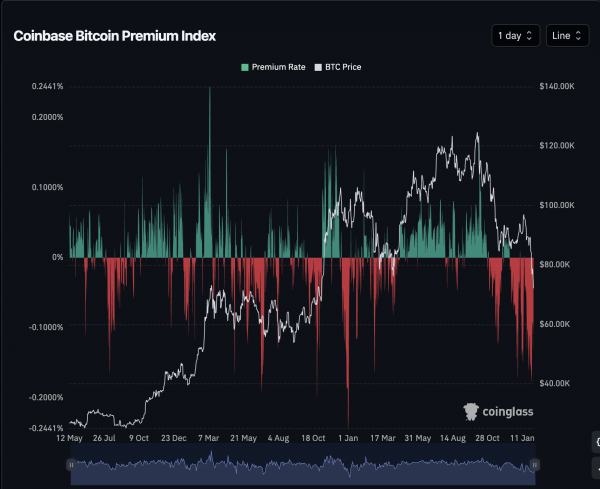

This weakness is reinforced by the Coinbase Bitcoin Premium Index, which has remained firmly negative in recent sessions.

The index, indicating U.S. spot demand, shows BTC trading at a discount on Coinbase relative to offshore exchanges. This suggests subdued buying interest from U.S.-based investors even as price declines.

Historically, prolonged negative readings on the premium index have coincided with periods of distribution rather than accumulation. This adds to the bearish near-term outlook.

Bitcoin long liquidations accelerate downside move

Derivatives data indicates that forced liquidations played a key role in accelerating the latest leg lower.

Over the past 24 hours, Bitcoin liquidations totaled more than $235 million, with long positions accounting for approximately $198 million, according to Coinglass data.

Source: Coinglass

The largest liquidation clusters were recorded on major exchanges, including Binance, Bybit, and Hyperliquid. Long positions were wiped out on these exchanges as BTC lost the $75,000 and $73,000 levels in quick succession.

Short liquidations remained relatively limited, highlighting that the move was driven primarily by overleveraged bullish positioning rather than a short squeeze.

The liquidation heatmap also shows reduced open interest following the sell-off, suggesting leverage has been flushed from the system — though this has not yet translated into a meaningful price rebound.

Market context remains fragile

Bitcoin’s decline comes amid broader risk-off conditions across crypto markets, with altcoins also posting sharp losses and overall market sentiment remaining cautious. While volatility has increased, there are few signs of aggressive dip-buying at current levels.

From a technical perspective, traders are now watching the $70,000 psychological level as the next major area of interest.

A decisive break below that zone could expose BTC to deeper downside. At the same time, any recovery attempt would first need to reclaim the $75,000–$78,000 range to signal stabilization.

Final Thoughts

- Bitcoin’s drop below $72,000 was driven by weak spot demand and heavy long liquidations rather than short-side pressure. Until spot buying improves and leverage resets further, downside risks are likely to remain elevated.

Next: Bitcoin’s THIS profit signal is weakening — Why BTC traders should watch

Source