Ethereum fund holdings surge 138% – Altcoin rotation in progress?

Is this the beginning of new market leadership?

Key takeaways

Содержание статьи:

Is ETH doing better than BTC now?

Institutional ETH fund holdings have surged 138% in a year, nearly four times Bitcoin’s 36% growth.

What could happen next in the crypto cycle?

Analysts expect capital to rotate from Bitcoin into altcoins, with Ethereum leading the next major rally.

Ethereum [ETH] is stealing Bitcoin’s [BTC] spotlight. Institutional investors are pushing ETH above and beyond, boosting fund holdings by 138% in a year. This is nearly four times Bitcoin’s pace!

The king altcoin is more than just an alternate crypto play now.

Ethereum races ahead

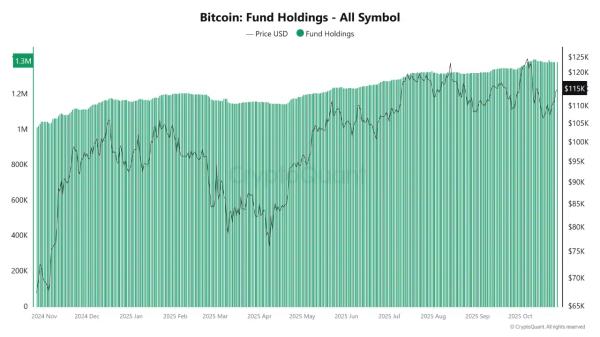

Source: CryptoQuant

Bitcoin is watching as Ethereum steps out of its shadow.

Source: CryptoQuant

Fund data shows ETH holdings have surged 138% year-over-year to roughly 6.8 million ETH. This is heavily driven by spot ETF inflows, staking yields, and its expanding role in DeFi and tokenization.

Source: CryptoQuant

Bitcoin continues to serve as a stable reserve asset, with fund holdings rising a modest 36% to 1.3 million BTC.

Institutional investors are adjusting their strategies, and capital is still flowing into Bitcoin, but with greater caution. In contrast, Ethereum’s rapid growth highlights its current breakout momentum.

And Ethereum isn’t the only altcoin gaining traction.

Ready for the next rotation?

Bitcoin may still lead the Altcoin Season Index, but things are changing.

According to Joao Wedson, CEO, Alphractal, the current setup is very similar to previous market cycles, where Bitcoin strength peaks just before capital rotates into altcoins.

Source: Alphractal

Only four out of 55 tracked altcoins have outperformed BTC in the past 60 days, but that lack of breadth is often followed by a rebound in risk appetite.

Source: Alphractal

Wedson believes that this is the accumulation window, when newer altcoins quietly bottom before the next rotation begins.

As seen in the performance charts, early-cycle tokens like Synthetix [SNX] and Binance [BNB] have already started posting higher relative returns.

Source: Alphractal

Adding to that, a long-term chart comparing altcoins and Bitcoin shows a familiar pattern. Big altcoin rallies followed Bitcoin’s peaks in 2017 and 2021.

Source: X

The setup now looks similar for 2025, with altcoins breaking out of a multi-year wedge. That could be where the next rotation begins!

Next: Bitcoin loses its whales to retailers – Is BTC’s consolidation ahead?

Source