BNB transactions hit 3-month high: Can rising utility fuel prices?

BNB could be on the path to a bullish breakout, supported by a strong uptick in on-chain activity.

Key Takeaways

Содержание статьи:

Recent activity shows a sharp increase in BNB usage for transaction finalization as smart contract deployments on the network continue to rise.

Binance Coin [BNB] made little movement in the past day, but it has maintained a bullish stance over the past week, posting a 12% gain.

On-chain metrics suggest that BNB usage is accelerating and could open the door for a major rally, possibly within the week. AMBCrypto’s analysis reveals both long and short-term factors supporting this outlook.

The door opens for BNB

Long-term metrics show a parallel rise in BNB transaction count and the number of users interacting with the network.

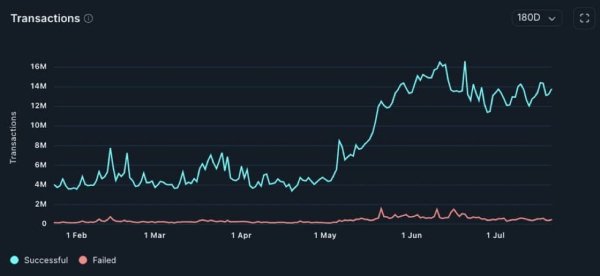

According to Nansen, BNB’s total transaction count surged to 14.1 million, its highest level since April—marking a 3-month peak.

Source: Nansen

This increase in activity was also reflected in user growth. Data from Artemis shows that monthly active users surpassed 33 million, the highest in three months.

Such a surge in user activity signals strong demand for BNB and may have contributed to the asset reclaiming the $760 price region once again.

Short-term outlook remains bullish

BNB’s short-term outlook also appears strong, driven by rising on-chain utility.

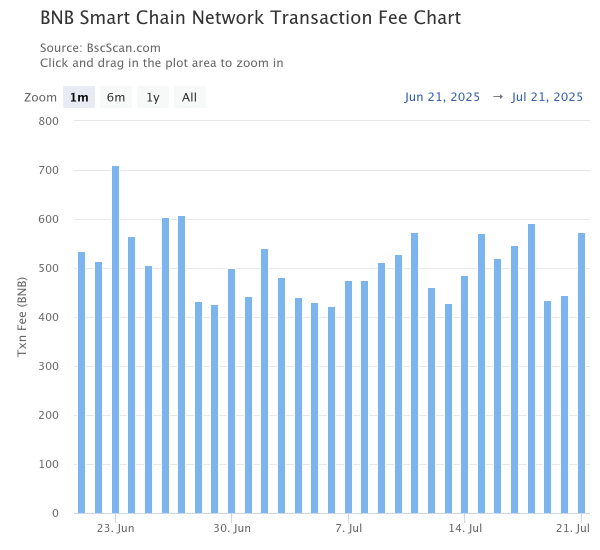

In the past 24 hours alone, transaction fee payouts jumped significantly. According to BscScan, 573.46 BNB—worth approximately $438,000—was paid out in fees, highlighting increased network utilization.

Source: BSCscan

This uptick aligns with the rise in verified smart contracts on the chain.

In the same period, verified contracts rose by 49.26% to 403, indicating that over 200 new contracts were deployed to facilitate transactions—contributing to the fee increase.

This short-term trend underlines growing utility for BNB, which could fuel further price growth as demand continues to rise.

Rising liquidity in the market

Liquidity is also improving across the BNB ecosystem, as reflected in Total Value Locked (TVL).

TVL is a key indicator of investor participation. When it rises, it often points to increased confidence and a bullish long-term view. Conversely, a decline usually signals fading market interest.

Press time data on DeFiLlama shows TVL surged to $8.51 billion in the past day, its highest level so far in July.

Source: DeFiLlama

Sustained growth in TVL suggests that investors are locking up their assets with expectations of higher future valuations, reinforcing bullish sentiment.

While BNB’s long-term outlook remains bullish, recent on-chain activity also supports short-term growth potential. If this momentum continues, BNB could be well-positioned to retest previous market highs.

Subscribe to our must read daily newsletter

Next: XRP prices consolidate – Will $260M in shorts spark a reversal?

Source