RENDER surges 12% – Examining 2 possible reasons behind the rise

Render rallies 12% as whale orders and trading activity rise across key markets.

Render posted a strong 12% gain over the last 24 hours. The move placed RNDR among the top beneficiaries of the recent dollar weakness.

According to the latest Consumer Price Index data, there was a decline in both monthly and yearly readings. That shift pressured the dollar. Risk assets responded quickly.

The whole crypto space has reacted to the reports. Render reacted sharply as well. However, the rally may not be driven solely by macroeconomic factors.

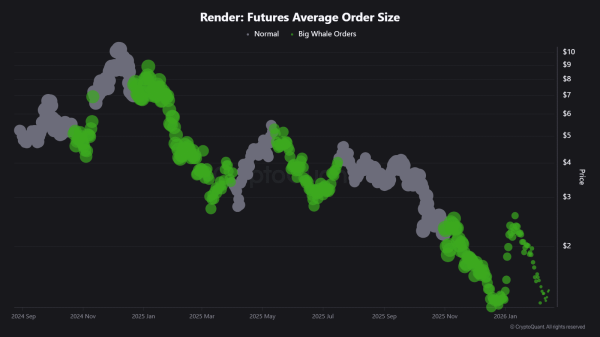

Whale orders spike at current levels

Содержание статьи:

On-chain data showed a significant rise in whale orders over the past day until press time. Large players are becoming active near current prices.

That matters. Whale participation often shapes short-term direction. When large orders increase during a rally, it signals conviction rather than passive speculation. It also increases the probability of volatility expansion.

Still, context is key. Are whales accumulating or distributing? As for Render’s case, early signs suggest positioning, not exit behavior.

Source: CryptoQuant

Trading activity accelerates

Render’s trading volume has surged across both Spot and Futures markets.

Usually, Spot activity reflects real buying and selling. Futures activity reflects leveraged positioning. When both rise together, momentum typically strengthens, participation expands, and liquidity deepens.

The increase suggests that traders are not ignoring the move but engaging with it.

Source: CryptoQuant

Can bulls overcome seller pressure?

Despite the rally, seller dominance has not disappeared entirely. The market structure still reflects prior distribution zones. For RNDR to extend gains, buyers must absorb overhead supply.

On the daily chart, the token price is tied to a flag consolidation pattern.

However, the momentum is accumulating steadily, and the liquidity cluster at around $1.680 could accelerate the momentum and initiate the anticipated breakout.

Source: TradingView

If whale orders continue rising and trading activity remains elevated, bulls could outpace sellers. That would allow momentum to build beyond a simple relief bounce.

For now, Render has momentum, trading volume, and increased whale interest. However, the next move depends on the follow-through buying spree.

Final Summary

- Render gained by 12% as the dollar weakness boosted risk assets. Whale orders and Futures activity surged, signaling rising participation among the investors and traders.

Next: Hedera reclaims key resistance, eyes trend reversal: Can HBAR hold above $0.10?

Source