Why experienced investors are quietly betting on altcoins in 2026

Crypto looks boring right now. Historically, that’s when the biggest moves begin.

In the first weeks of 2026, the overall crypto market has been under heavy pressure. Prices have fallen nearly 46% from their peak in October.

When Bitcoin [BTC] dropped to the $68,000 range, many investors became extremely fearful. However, instead of panic selling, the market has stayed more stable than expected.

While Bitcoin is struggling, some selected altcoins are starting to perform better.

For experienced investors, this is not just a short-term bounce. It may be the early sign of a new kind of “altcoin season.”

The community sees the hype around altseason

Содержание статьи:

This sentiment was echoed by analysts on X, where the consensus suggests that the most explosive altcoin bull markets typically ignite precisely when the retail crowd has looked away.

Drawing parallels to the legendary 2017 cycle, one prominent analyst noted that while the modern market moves on a naturally elongated timeframe, the underlying technical structure is hauntingly similar.

Source: X

The analyst believes that the current stagnation isn’t a sign of death but rather the quiet accumulation phase that historically precedes a parabolic shift in dominance.

He said,

“2026 will be the year of altcoins.”

Echoing a similar sentiment, another X user noted,

“BULLISH #Altcoin season has officially started getting ready for 1000X.”

Source: Whale Satoshi/X

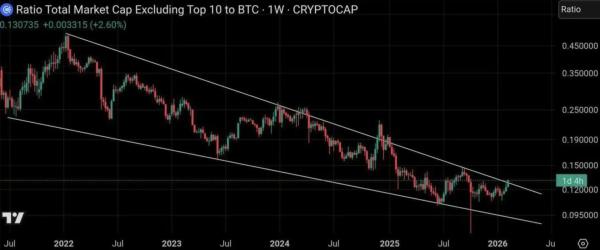

According to these analysts, charts show that altcoins may be getting ready for a strong breakout after being in a long downtrend for several years.

They believe that while most small investors are focused only on Bitcoin’s price, big investors are quietly preparing for a wider market move.

With clearer rules and regulations coming in, large institutions may soon start investing heavily in useful crypto sectors.

These include real-world assets (RWA), DeFi platforms, and blockchain systems used by banks and companies.

Supporters of this view think the next big crypto projects are already in front of us, but many people are ignoring them. They believe the chance for major gains could come within months, not years.

However, real data tells a more cautious story.

Is the data in favor?

As of February 2026, CoinMarketCap’s Altcoin Season Index is only 31 out of 100. This means the market is still in “Bitcoin Season.” In simple terms, most major altcoins are not doing better than Bitcoin right now.

Bitcoin’s market dominance is also close to 60%, showing that most money is still flowing into Bitcoin. Investors still see it as the safest option during this recovery phase after the last market peak.

So, there is a clear gap between online excitement and actual market behavior.

Swissblock’s analysis also shows that the market is now in a neutral phase. All in all, the market is ready to move; it is just waiting for the right moment.

Final Summary

- Social media optimism suggests a breakout, but current data still favors Bitcoin. Fear has not triggered mass panic selling, which shows growing investor maturity.

Next: Ethereum’s bearish positioning deepens: Is strategic whale rotation why?

Source